How do Africa’s regions compare?

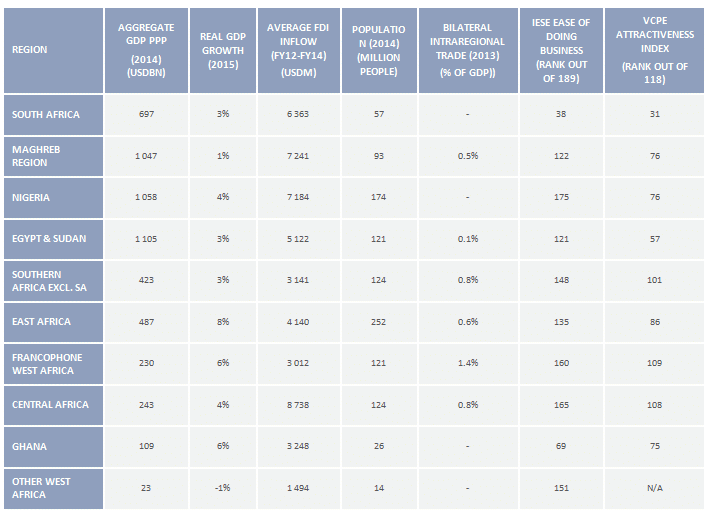

What makes a region attractive to investors? RisCura has analysed Africa’s regions from a number of perspectives to determine their relative attractiveness. The table below shows the regional comparison of the aggregated sizes of the economies, their GDP growth, the amount of external investment they receive in the form of FDI, the sizes of the populations, the amount of trade that occurs within each one, as well as their rankings by ease of doing business, attractiveness. (weighted according to GDP).

On a purchasing power parity (PPP) basis, the largest regional GDPs are the Maghreb, Egypt & Sudan, and Nigeria. The most densely populated regions in Africa are East Africa and Nigeria, at least 50 million people larger than the other regions. East Africa is especially large with Ethiopia’s population of 91 million (2014 estimates).

GDP growth for 2015 varies from negative growth, to 8% real GDP growth forecast for the year, further highlighting just how different the characteristics of these regions are. The more developed regions on the continent including the Maghreb, South Africa, Egypt & Sudan and Southern Africa are expecting real GDP growth of around 3%. The Maghreb region is biased downwards because of negative growth expected in Libya, which impacts the region. Other West Africa is forecast to decline in 2015, as the countries worse-hit by the Ebola outbreak will take some time to recover.

More high growth areas include Francophone West Africa, Ghana, and East Africa (the frontrunner) with 8% forecast for the year. Nigeria, whose GDP growth forecast was approximately 9% for 2015 less than six months ago, has been adjusted downwards significantly due to the drop of global oil prices. The oil price decline has impacted the GDP of the country directly through lower oil revenue, and indirectly through increased inflation due to the depreciation in the currency. The uncertainty leading up to the elections that took place in March 2015, as well as the insecurity in the North of the country have also become deterrents to investors, further impacting growth. The result of the elections was very positive, with ex-President Goodluck Jonathan peacefully handing over power to newly-elected Muhammadu Buhari.

Southern Africa (ex-SA) has received erratic but improving FDI inflow, increasing from USD 1.6bn in 2012 to USD 6.0bn in 2014. Egypt & Sudan have experienced a similar increase from USD 1.5bn to USD 8.6bn over the period. Nigeria’s FDI inflow, on the other hand, has declined from USD 8.9bn in 2012 to USD 5.6bn in 2014 in the lead up to the 2015 elections and increased economic volatility on the back of the lower oil price.

It is interesting to note that when it comes to trade, Francophone West Africa appears to be the region that relies most heavily on its neighbours. East Africa and the Maghreb region, however, score low on intraregional trade, showing less interdependence. Egypt’s trade with Sudan is limited, which is understandable given Sudan’s recent political history. It is worth noting that Egypt’s trade with the Maghreb region far outranks that with Sudan, but in general, Egypt’s trade within Africa has declined dramatically over the past few years to less than 3% of its total, with no African country, apart from Libya, making it onto the top 15 export markets (the Economist).

Looking at the rankings by ease and attractiveness, the Maghreb region and Nigeria for example, score the same on a weighted-average basis with respect to attractiveness, but when considering the ease of doing business, the Maghreb region far outranks Nigeria. In fact, Nigeria is considered in the top 15 most difficult places to do business, out of the 189 countries around the world that are ranked. Ghana and East Africa on the other hand, both have relatively strong rankings, falling behind only South Africa, Maghreb and Egypt & Sudan regions.